MACRS Depreciation and Tax Credits for Commercial Solar Systems Explained

What is the MACRS depreciation benefit?

MACRS depreciation is a way for your business to recover some of the capital costs of your solar installation. It lets your business deduct the appreciable basis over five years, reducing tax liability and accelerating the rate of return on your solar investment.

For systems in which an Investment Tax Credit (ITC) is taken, the owner must reduce the project’s appreciable basis by half the value of the ITC. This means the owner can deduct 85% of his or her tax basis. “Depreciation” is the loss of value that occurs over time when the object purchased is used for a specific use. As a business owner, you are eligible to deduct this “loss in value” from your taxable income when used for your business. If you are running a profitable business, and you can show that the solar power you are generating is for business use (as opposed to personal use), then it may have a strong impact on your bottom line.

What tax credits are available?

The Investment tax credit (ITC):

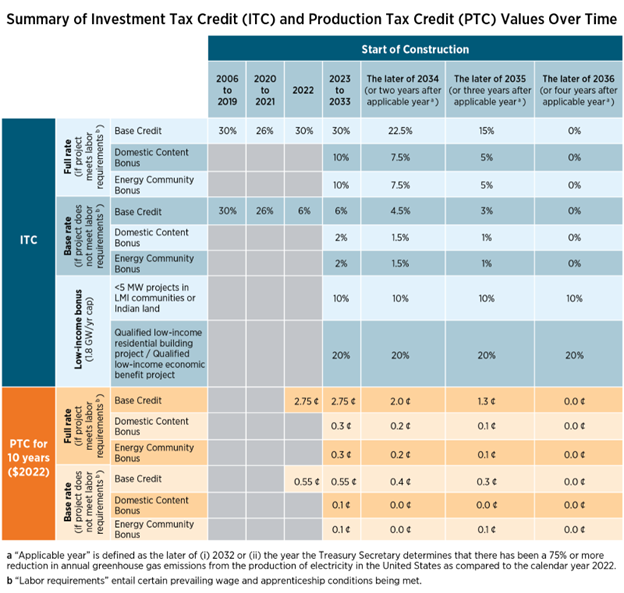

The ITC gives you a percentage of the cost of your solar system as a tax credit. For example, if you spend $100,000 on a solar system and the ITC is 30%, you can claim $30,000 as a tax credit. The ITC is available for solar systems that start construction before 2033 and meet certain labor requirements. The percentage of the ITC varies depending on when you start construction and whether you meet additional bonuses for domestic content or energy communities.

The Production tax credit (PTC):

The PTC gives you a fixed amount of money for every kilowatt-hour (kWh) of electricity your solar system produces during the first 10 years of operation. The PTC is available for solar systems that start construction before 2033 and meet certain labor requirements. The amount of the PTC varies depending on when you start construction and whether you meet additional bonuses for domestic content or energy communities.

Below is a chart from the Department of Energy showing more details of the ITC and PTC

The exact value of the MACRS Depreciation benefit, ITC and PTC tax depends on your business and tax situation, so it's best to work with a tax expert or consultant to determine how much MACRS could help you.

Please see more details at the Department of Energy web site here

Contact your Forecast Solar Consultant at any time with questions or to request a no-obligation solar cost/benefits assessment for your business. Again, all the tax information in this document is generalized for describing the basic opportunities that currently exist in commercial solar. Consult your own tax preparer to learn how these solar benefits might affect your specific financial situation and future business plans.